Visa and Mastercard built arguably two of the most impenetrable payment businesses in the world. Both of them run on an open loop payment system connecting the issuing banks, payment processors, card network etc. While the card networks’ i.e. Visa, Mastercard’s sky-high margins (typically ~60-70% operating margin) caused plenty of envy among payments value chain participants, their three-sided networks (customers, merchants, and banks) have been pretty damn difficult to dislodge. Ben Thompson once mentioned:

Once a job is done — and credit cards do their jobs very well — it takes a 10x improvement to get users to switch, and, in a three-sided network, that 10x is 10^3

While Visa and Mastercard were always meant to be pervasive, FleetCor was founded in 1985 with a much narrow focus. It provided a proprietary closed loop card service (known as “FuelMan Fleetcard”) to commercial fleet operators at pre-designated merchant sites that are part of the “FuelMan” network.

Why would fleet operators choose such a card instead of Visa/Mastercard? The fleet operators receive a greater discount on their fuel purchases than traditional credit cards. Moreover, FleetCor can restrict unauthorized purchases (cigarettes, food etc.) on the fuel stations. Finally, fleet operators would receive a detailed report on fuel and expense management from FleetCor. In the early years, it was free for fleet operators to use FleetCor’s cards, so there was no downside for fleet operators anyway.

Why would merchants be interested in accepting FleetCor’s cards? First of all, fleet operators that are part of the network would be obviously incentivized to go only to outlets accepting FleetCor’s cards, increasing traffic to the stores. Since drivers are likely to go inside the store to buy more high-margin products (food, tobacco, drinks etc.) on their own, accepting fleet cards can lead to more profitable sales.

Unlike Visa/Mastercard, FleetCor deliberately avoided ubiquity in the initial years and selected only a few merchants from an area to create a sense of “semi-exclusive” network so that those merchants could enjoy increased traffic and sales. For the privilege of such increased traffic, merchants would pay a transaction fee of 500 bps as percentage of gross revenue which is nearly ~2x the traditional credit cards. Because of the closed loop nature of the network in which FleetCor controls everything, they don’t have to share the economics with everyone in the open loop payment value chain, and can keep the entire economics. It’s a nice business if you can get it!

In the early years, FleetCor went for licensing model that effectively created regional franchises who would do the hard work of convincing local merchants to accept FleetCor’s cards. In return, these franchises would pay ~10% of their revenue to FleetCor. Unfortunately, that didn’t turn out so well as many franchises were struggling to remain profitable. Fortunately, FleetCor had the option to buyback these franchises at a pre-defined formula that allowed FleetCor to buy them back at 3.9x EBITDA in 2001.

Around the same time, FleetCor hired Ron Clarke, a former President of the ADP Electronic Services Division, who built the business line at ADP from zero to $300 mn in four years. Ron Clarke remains CEO of FleetCor today and given FleetCor was really struggling when he joined in 2000, one can argue almost the entire market cap of FleetCor today has been created under Clarke’s leadership.

A decade after Clarke started running FleetCor, it came to IPO in 2010 at ~$2 Bn market cap. Today, its market cap is ~$17 Bn, implying a CAGR of ~18% over ~13 years even though the stock is almost flat over the last 5 years.

A lot has changed over the last decade or two. While initially it was free to join fuelman network for fleet operators, now you have to pay for analytics, fraud coverage, and to be part of their rewards program.

Moreover, it’s not just Fuelman network anymore; FleetCor acquired a number of networks over the years to fortify their closed loop network. Today, FleetCor’s closed loop is a combination of four separate networks in North America: Fuelman (accepted in 55k+ gas stations), Comdata (~8.6k+ truck stops), Commercial Fueling Network or CFN (~2.6k+ fueling sites), and Pacific Pride Fueling Network (~1.1k+ fueling sites). Beyond North America, FleetCor has two separate closed loop payment networks in the UK (Allstar and Keyfuels), one in Czech Republic (CCS), Mexico (Efectivale), Brazil (CTF), Netherlands (Travelcard), Australia (Fleet Card), and New Zealand (CardSmart).

It’s not just closed loop network either, FleetCor now also partners with Mastercard in North America (accepted in 176k+ fuel sites and 398k+ maintenance sites) and Visa in the UK (~8.4k+ sites) to provide “white-label” service to customers who want to have their own branded cards. So in some sense, FleetCor has bit of a “Switzerland” approach that allows them to serve their customers any way they want. Of course, FleetCor has fewer controls over these “white-label” cards (easier to implement various specific restrictions over closed loop network than open loop network) and the economics for white label vs their proprietary network is much less lucrative since they do need to share the economics with Mastercard and their brand partners.

Fleet cards are sticky business. Both customer retention and revenue weighted volume retention are 91-92% (FleetCor discloses this number for the whole company, so segment specific retention can be slightly different). Half of the churn is due to involuntary reasons (e.g. bankruptcy).

~50-60% of Fuel segment’s revenue is fees revenue, much of which is discount fees earned from the merchants. ~30% of fuel segment revenue in 2022 was directly influenced by absolute price of fuel and ~15% of the segment revenue was tied to fuel price spreads. While higher oil price is largely beneficial to fuel segment revenue, there are some nuances to it. Higher oil price also leads to lower demand for oil and increases bad debt expense. ~10-12% of fuel segment revenue is late fees or financing charges and 30-35% is interchange revenue.

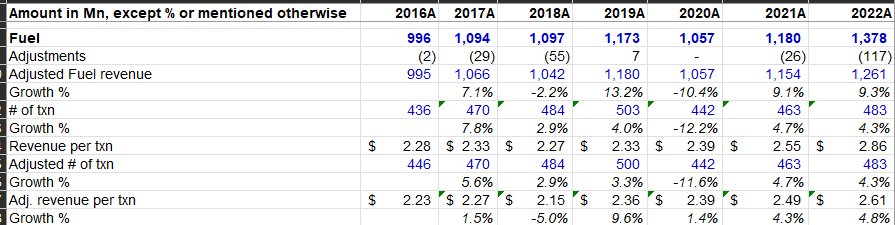

While FleetCor’s fuel segment has eclectic sources of revenue, management identifies number of transactions as a Key Performance Indicator (KPI) for this segment. While this KPI has recovered since Covid, number of transaction in 2022 was 471 mn which was still ~5% lower than 2019. Revenue from this segment, however, surpassed pre-pandemic level, thanks to increase of revenue (adjusted) per transaction from $2.33 in 2019 to $2.68 in 2022. (Please note the adjustments account for fuel price, FX, acquisitions, divestiture related impacts).

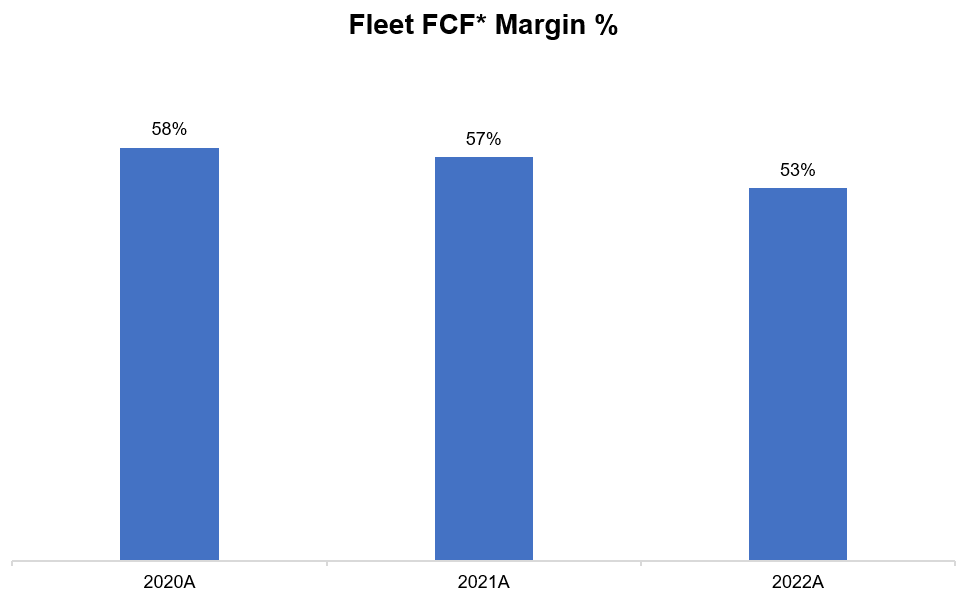

When Ron Clarke joined FleetCor in 2000, it had $23 mn revenue and just 10% EBITDA margin. After buying back the struggling franchises and centralizing corporate functions such as accounting, he transformed FleetCor into a money printing machine within just five years as the company reached ~45% EBITDA margin in 2005. Today, FleetCor Fleet segment’s FCF margin of ~50-60% resembles the margin profile of Visa/Mastercard.

While FleetCor was founded to serve the commercial fleet operators, its tentacles have moved way beyond fleet business. Since 2002, FleetCor acquired 95 companies, most of which are non-fuel related acquisitions. They correctly and carefully identified the various ways they could serve their core fleet customers. FleetCor understood fuel is just a fraction of all the expenses for their customers; much of their Accounts Receivable/Payables function was done in antiquated fashion which led them to focus on Corporate Payments. FleetCor also realized that they could play a key role in helping the fleet drivers book and pay for hotels when they are on the road. FleetCor largely developed these capacities thanks to acquisition spree Ron Clarke undertook over the last two decades. In doing so, they also expanded their customer footprint way beyond just fleet operators as the non-fuel segments’ customer base expanded to other industries. Today, Fuel is just 40% of FleetCor’s consolidated revenue.

Even though majority of FleetCor’s revenue is non-fuel related, long-term sustainability question around fuel business casts a shadow among many investors mind. As the world tries to lower their reliance on fossil fuel for transportation, it is a top of the mind concern for FleetCor.

Before we delve into those concerns, let me give you a more solid overview of the non-fuel segments as well as FleetCor’s EV related initiatives.

Then I will discuss the competitive dynamics FleetCor faces which will be followed by capital allocation and management incentive related discussions. Finally, I will elaborate on what’s embedded in today’s stock price and why I have chosen to be a shareholder.