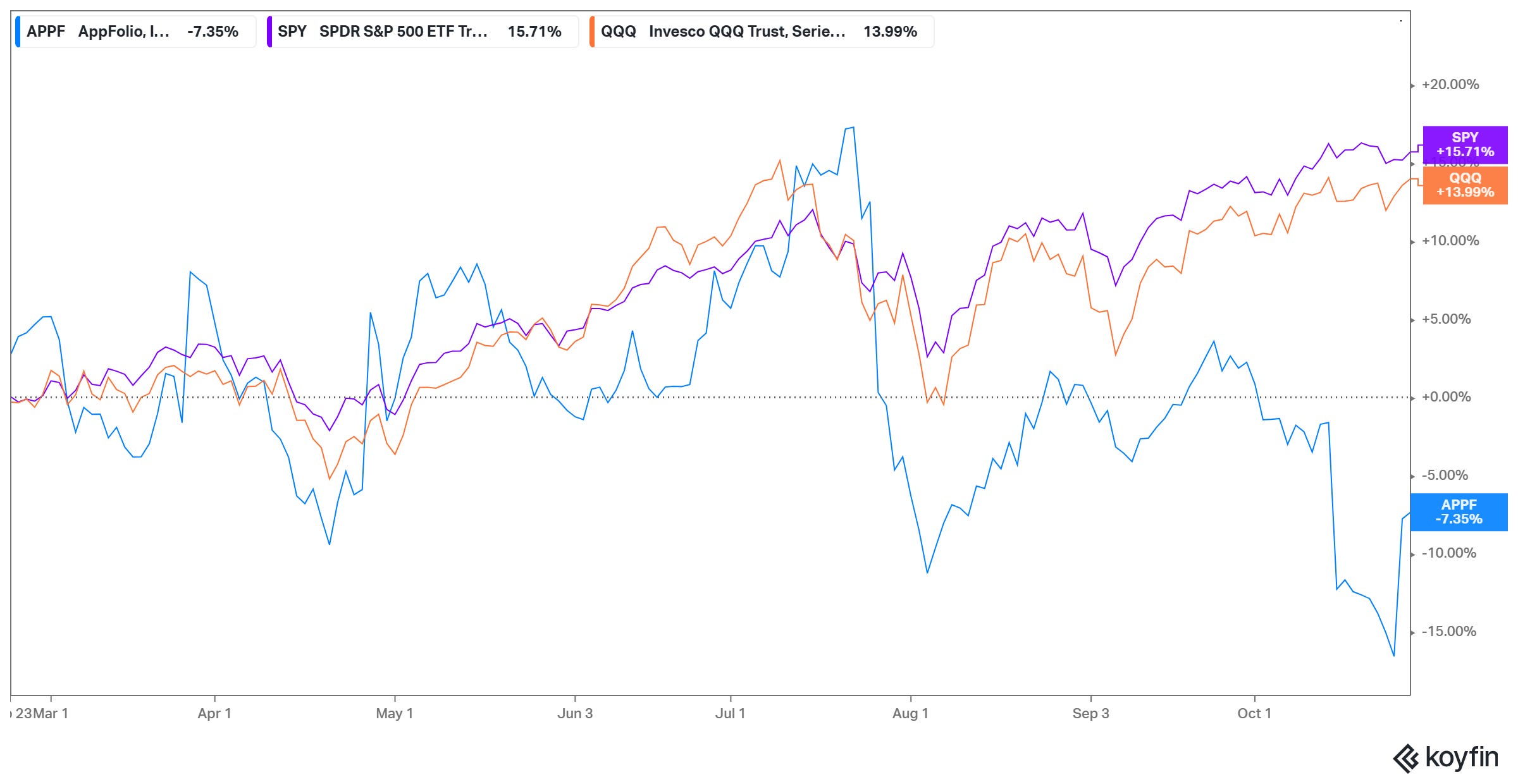

Today, I have started a ~3% position in AppFolio (APPF) at $214.2/share. Back in February this year, I published my Deep Dive on AppFolio. Since then, the stock has underperformed both S&P 500 and QQQ by more than 20%.

For the uninitiated, I would encourage you to read the Deep Dive to understand the nitty-gritty details around the business. I will briefly share here what prompted me to buy the stock now.

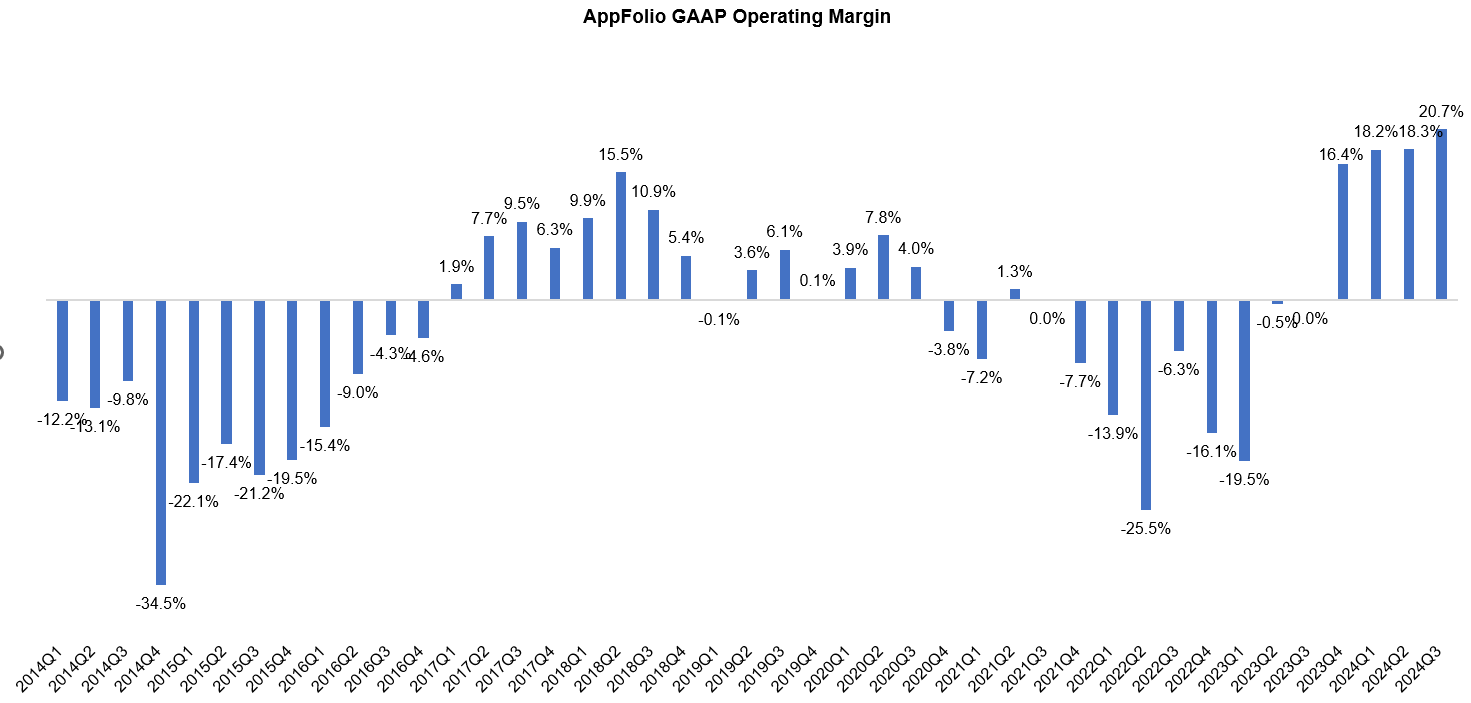

In my original Deep Dive, I wondered if I was being too generous to AppFolio for underwriting ~26% terminal operating margin when it was merely breakeven in 2023. As the year progressed, I started realizing I was anything but generous. Let me give you more context.

In 2022, AppFolio generated $472 Million revenue. Management just guided 2024 revenue to be in the range of $786 to $790 Million. As a result, APPF's revenue has increased by ~67% over the last two years. What really got my attention is their operating expense (R&D+S&M+G&A) is only up ~10%. Everyone knows about near zero marginal cost of software and how beautifully a software company can be scaled, but I think recent silliness around software industry during ZIRP era almost made us oblivious to such simple truths!

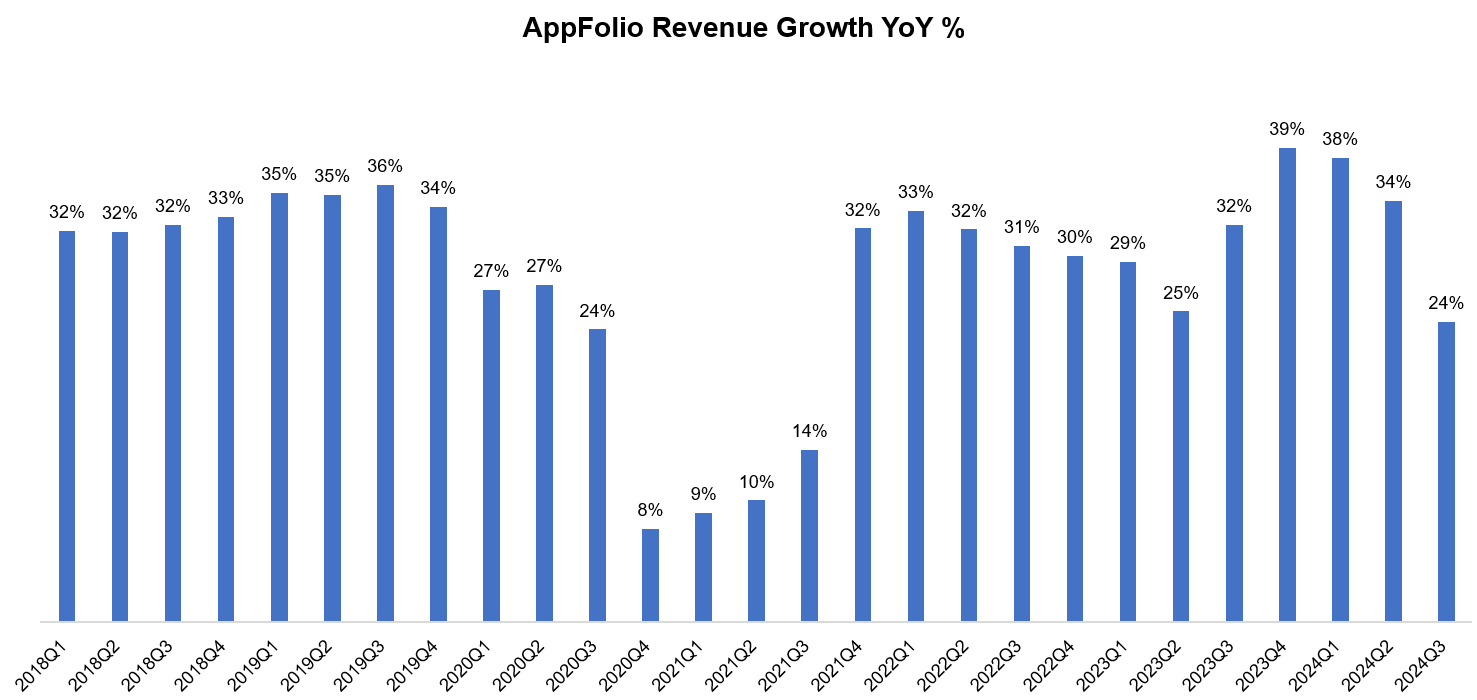

While we hear about the tension between growing topline and showing margins for software companies, AppFolio managed to not be constrained with such dichotomy. Their revenue grew by more than 30% in both 2022 and 2023 and this year will likely end at ~27% revenue growth. Moreover, almost all of this growth was organic in nature. APPF just announced an acquisition of LiveEasy for $80 Million, but before this acquisition, they did their last major acquisition in 1Q'19.

While APPF managed to grow almost ~30% CAGR over the last two years, such growth is extremely unlikely to continue for the next couple of years. As you can see above, 3Q'24 revenue growth YoY came down to 24% and if you take the high end of the management guide, 4Q'24 topline growth will decelerate further to just ~17%. Moreover, if you look at the revenue growth in the first half of 2024, it is easy to see APPF has some really tough comps ahead of them in 1H'25.

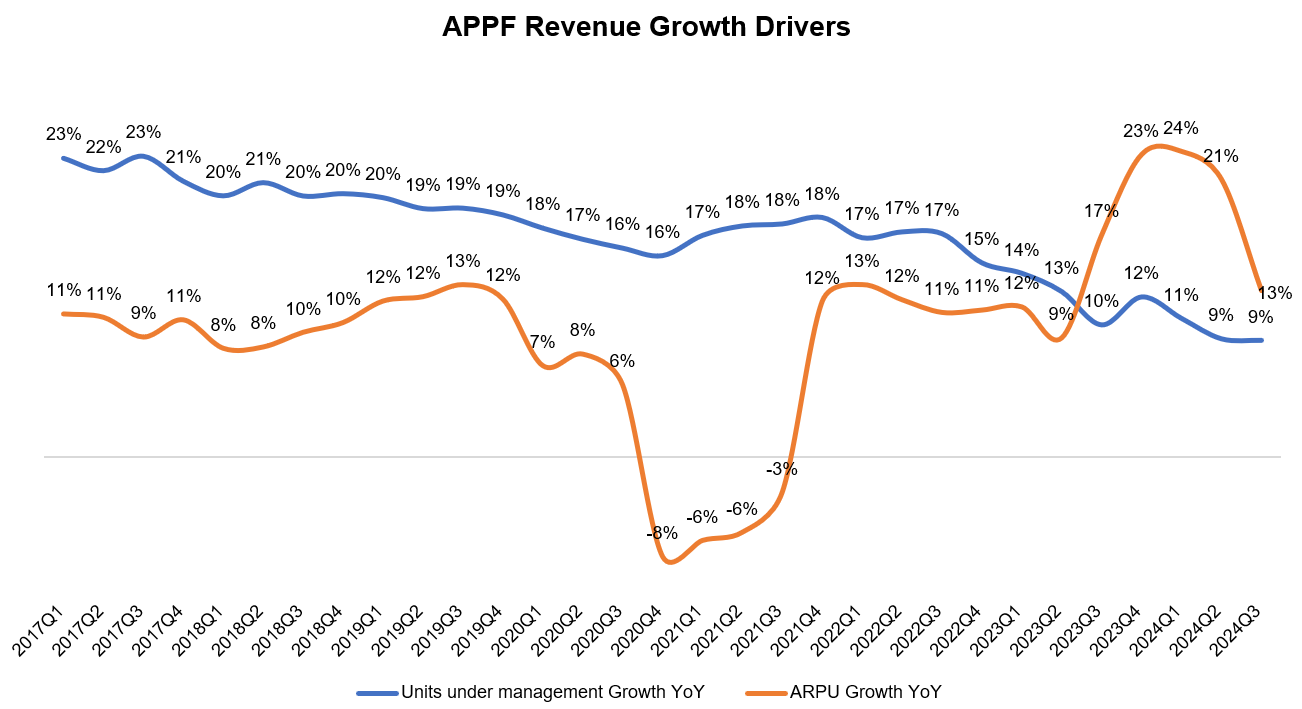

While I went to a more granular drivers in my Deep Dive, let me simplify here. There are essentially two primary drivers for APPF's revenue growth: a) increasing units under management, and b) increasing Average Revenue Per Unit (ARPU) which is calculated as just revenue divided by average units under management.

For much of APPF's history, increasing units under management was their primary driver for growth. However, in the last five quarters, it was ARPU that's driving their topline. One of the key drivers for ARPU growth in recent quarters was eChecks, or electronic checks, which allows tenants to pay rent online. AppFolio started charging $2.49 per transaction for all eCheck payments on July 31, 2023. Right after implementing this, APPF's ARPU growth shot up in 3Q'23 and stayed higher than 20% for the next three consecutive of quarters. As APPF overlapped that quarter now, ARPU growth came down to just ~13% in 3Q'24.

Given this context, it is likely that ARPU growth may come down to HSD to LDD in 2025. The harder question is whether units under management will keep growing at ~10%. Current Consensus estimates imply high-teen revenue growth next year. So, if ARPU grows at ~10% next year, you need units under management to grow at ~8-10% to beat the consensus estimates. Compared to its 2023 units under management, in the first 9 months of 2024 APPF's units under management grew by only ~300k (vs ~500k in 2023, and ~700k in 2022). In fact, one of the concerns mentioned in my Deep Dive was that for APPF to keep its growth momentum, they will have to keep displacing the incumbents in the up market since the end market itself is only going to grow at a very steady pace. I don't have a compelling answer yet in terms of whether 2024 was bit of an anomaly for unit growth or it's the evidence of structural challenges for going up market.

There are couple of things that assuage my concerns a bit. After publishing my Deep Dive, I exchanged a couple of emails with one of my subscribers. He mentioned a couple of things that made me much more optimistic about sustainability of revenue growth. While I mentioned I came away a bit unimpressed with AppFolio's unit growth trajectory compared to RealPage (I did give a caveat that lot of the growth was inorganic and I couldn't decipher RealPage's organic growth), he mentioned based on RealPage's disclosure in the past, one could infer they were growing units organically only ~3-4% before they were acquired by Thoma Bravo for $10.2 Billion in 2020. For context, RealPage was acquired at ~14x LTM gross profit whereas AppFolio today is trading at ~15x LTM gross profit despite growing their revenue organically at a much faster rate. He also mentioned overall organic growth for RealPage was still ~10%, thanks to ARPU growth.

I'm willing to look past the potentially dicey 2025 consensus estimates and would like to start owning this company for a couple of reasons:

a) the structural growth in place remains robust beyond 2025. ARPU growth can sustain at HSD to LDD rate beyond 2025 once they launch more and more other value added services over time. So I think the probability of mid-to-high teen topline growth for the rest of this decade is likely high.

b) There is an element of incentive that I missed in my original Deep Dive which was pointed out by one of my subscribers. Olivia Nottebohm joined on AppFolio's board in 2023. Nottenbohm is currently the COO of Box. Her former roles include Chief Revenue Officer at Notion Labs, COO at Dropbox etc. She has a very interesting compensation agreement with Reece Duca (the largest and controlling shareholder of AppFolio). Let me directly copy from AppFolio's proxy statement:

"Mr. Duca has agreed to pay Ms. Nottebohm 35 percent of the net gain on the equivalent of 35,714 shares of the Company’s Class A common stock each year for the next seven years, which amount may be paid in cash or shares of the Company’s Class A common stock. The net gain will be based on a $100 per share starting value and the 10-day average of the final closing price of the shares prior to the date of payment, as reported by The Nasdaq Global Market. No part of such payment will come from the Company."

It is clear that the largest controlling shareholder of AppFolio is very keen to incentivize the board appropriately to keep the company (and the stock) in the right direction.

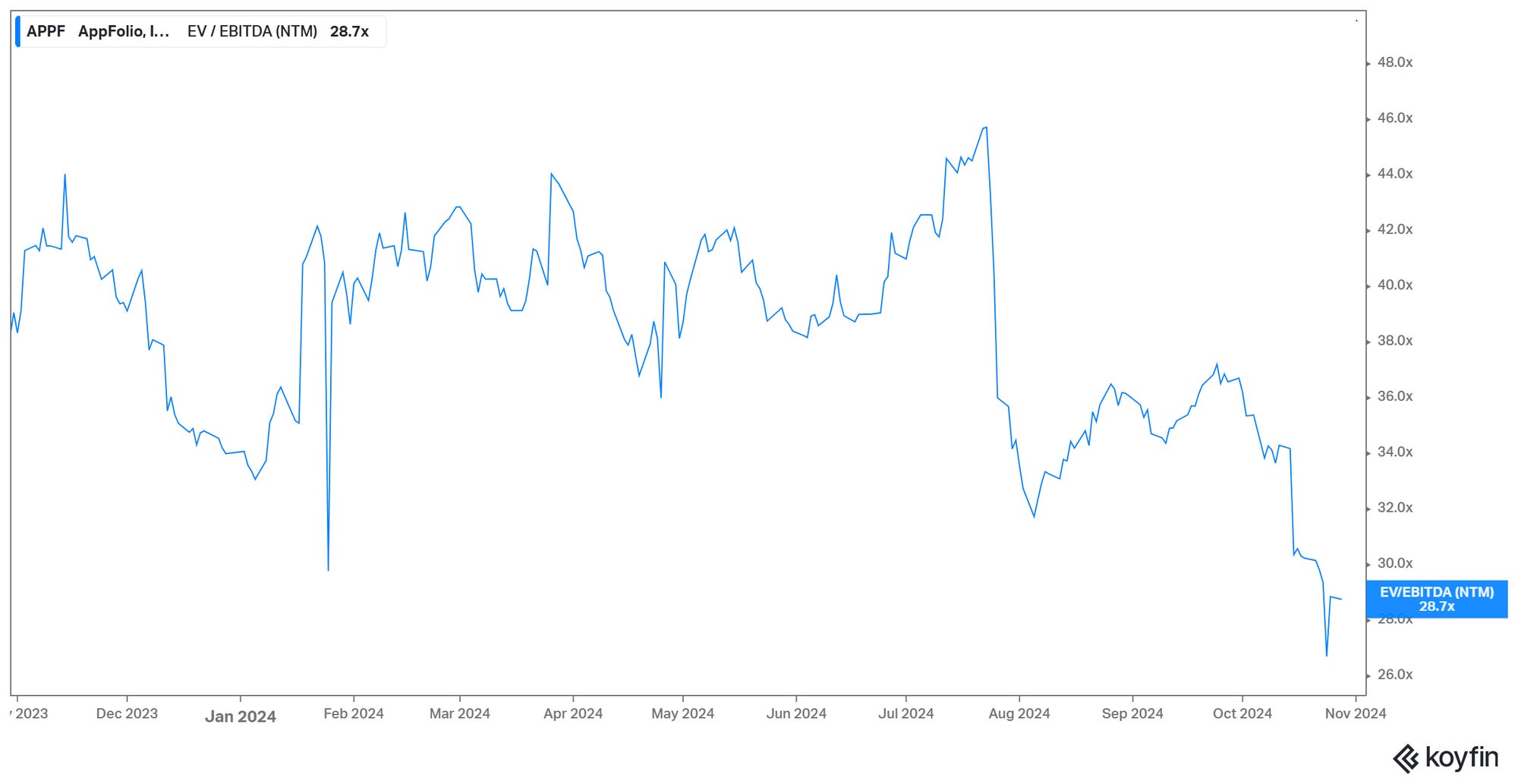

AppFolio is not optically cheap, neither is it trading at nose bleeding territory. But I think the near-term multiple can mask the attractiveness of the stock. The persistence of mid teen revenue growth with high incremental margin can lead to low teen IRR. IRR can improve further if the company ends up doing some consequential acquisitions along the way. I will be interested in buying more if the stock goes down from here.

I have uploaded a new excel model on APPF that subscribers can download below.

Thank you for reading.